Lucinity

AML Software Employs Neo4j AuraDB to Power AI Platform

Lucinity is an anti-money laundering (AML) software company that bridges the gap between AI and analysts to help banks fight money laundering and financial crimes. Founded in 2018, the company offers a human AI platform that brings together the creativity of human intuition and the computational power of machines.

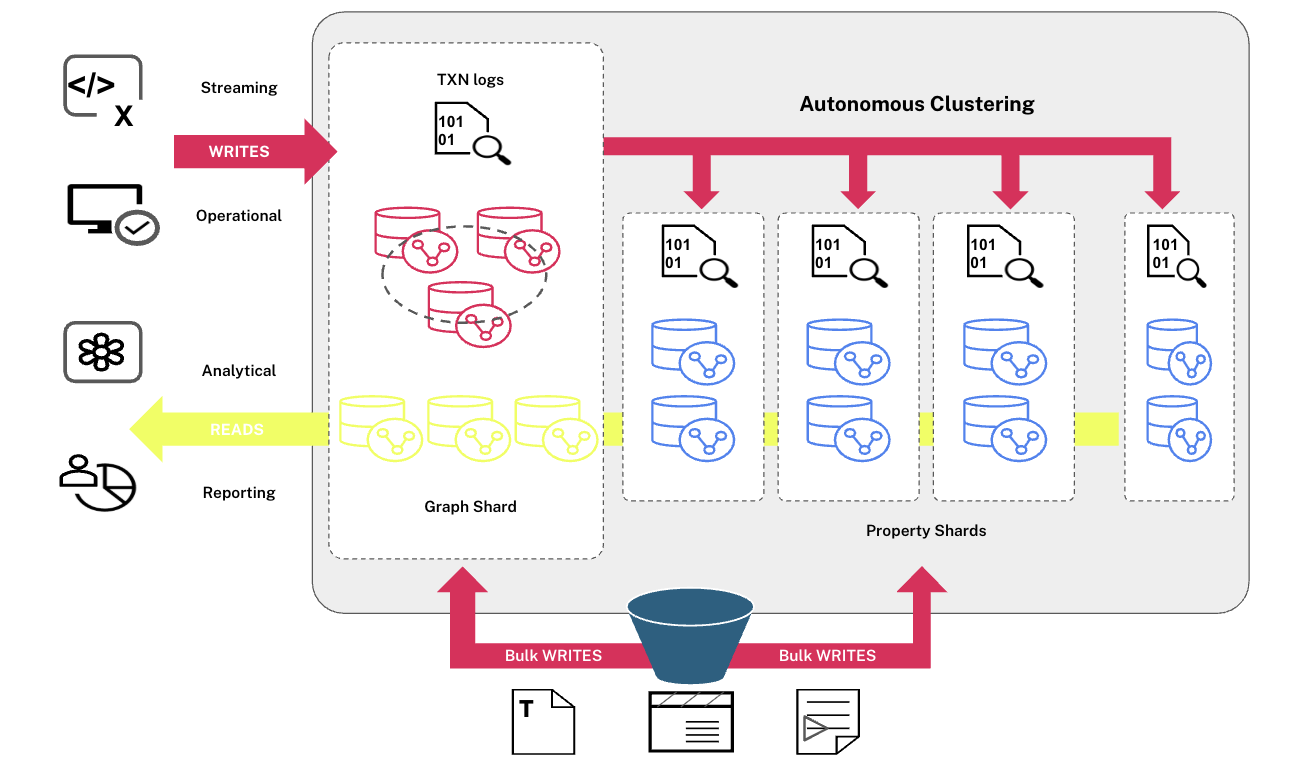

Lucinity derives insights from customer data using explainable AI technology, spotting suspicious activity based on relationships within the available information.

The Power of Graphs for Anti-Money Laundering

While most legacy AML systems and architectures currently deploy relational databases to store their information, Lucinity saw a graph database as a natural fit for fighting money laundering.

“Graphs themselves are natively designed to handle very connected and complex data structures in a very efficient manner. And to us this is the exact problem that we’re solving in AML. Leveraging the power of graphs and graph data science is really key in our detection case management software,” said Justin Bercich, Head of AI at Lucinity.

Graphs allow enterprises to identify patterns and notice otherwise overlooked connections, offering them a comprehensive view of all data relationships.

“Graphs empower Lucinity to really create linkages in our data, creating a 360-degree view of the actors and transaction networks that we monitor and really turn our investigators into superheros,” said Bercich.

With graphs, the AML company is able to detect deeper and more complex criminal networks by reducing false positives for normal behavior and improving the efficiency of their investigation workflows.

“Leveraging graphs to surface insightful connections between data points, customers, accounts, transactions and other important compliance and regulatory data points is key to finding money laundering,” said Bercich.

The Neo4j Graph Data Platform includes leading-edge graph data science capabilities, critical to Lucinity’s advanced AI. “Leveraging the power of graphs and graph data science is really key in our detection case management software,” said Bercich.

Graph data science enables Lucinity to delve deeper into complex criminal networks and money laundry networks. “For example, we’re able to detect a list of clusters using various community detection algorithms,” said Bercich. “We can mathematically analyze nodes and their importance through centrality and link analysis, and harness rich relationship data through expressive graphs and through abstract representational techniques and deep learning technology such as graph neural networks.”

A Cloud-First Approach with Neo4j AuraDB Enterprise

Like many modern enterprises, Lucinity prefers a fully managed cloud service like Neo4j AuraDB, which empowers the company to focus on its core expertise. Lucinity runs AuraDB Enterprise on Google Cloud Platform (GCP).

“At Lucinity, we pride ourselves on staying at the forefront of technology to help our clients solve one of the toughest problems faced by banks today – maintaining customer satisfaction while also rooting out the bad actors,” said Gudmundur Kristjansson, CEO. “Neo4j AuraDB Enterprise allows us to leverage the full power of native graph technology – from finding and predicting fraud patterns, to delivering the latest analytical and AI techniques to our clients. AuraDB’s ability to flex capacity based on usage, together with its fully managed simplicity and predictable cost, ensure we stay agile to meet the needs of our growing business.”

Benefits of running in the cloud include both freedom and control, says Bercich. “We know exactly what instances and databases are running in the cloud. We’re able to upscale and resource our databases based on data requirements and run complex queries deep into the network. The AuraDB Enterprise service itself allows us to focus on leveraging the power of graphs rather than having to continuously manage them.”

Lucinity streamlines AML compliance using a knowledge graph in Neo4j. The knowledge graph captures the intelligence and shared knowledge at Lucinity around regulations. But ultimately, reducing money laundering is the real goal.

“Money laundering is a blight on society,” said Bercich. “We’re up against very well-funded criminal networks with significant R&D budgets that utilize very sophisticated and dynamically evolving techniques to evade capture and detection. At Lucinity, through partnership with Neo4j, we can really leverage the synergies between our software to always stay one step ahead of the criminals.”