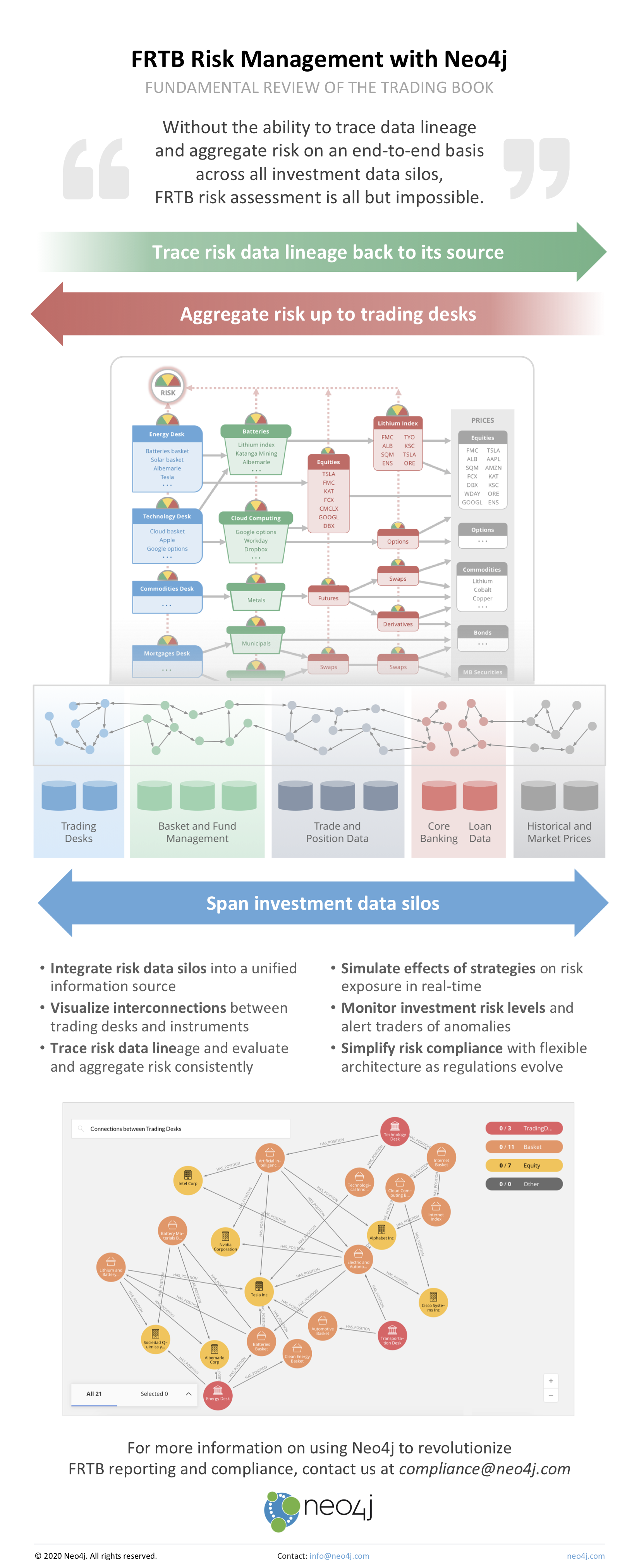

Effective Internal Risk Models for FRTB Compliance: Risk Management with Neo4j [Infographic]

Senior Director of Global Solutions, Neo4j

1 min read

In this series on the FRTB, we delved into what is required for effective internal risk models using a graph database like Neo4j. In previous weeks, we looked at the requirements of FRTB compliance and the relationship between risk modeling and data lineage.

Last week, we explained why modern graph technology is an effective foundation for compliance applications.

To bring it all home, we offer this infographic depicting how tracing data lineage across all investment data silos to do a proper FRTB risk assessment is next to impossible – and how a graph database is the key to effective risk management.

Like this infographic? Share it with your network on Twitter, LinkedIn or Facebook.