Top 10 Use Cases: Anti-Money Laundering

Chief Scientist, Neo4j

1 min read

opens in new tabGraph technology is the future. Not only do graph databases effectively store relationships between data points, but they’re also flexible in adding new kinds of

relationships or opens in new tabadapting a data model to new business requirements.

But how do companies today use graph databases to solve tough problems? In this blog series, we’ll cover the top 10 use cases for graph technology and for each we include a real-world example. This blog series continues with a look at using graph technology with knowledge

graphs.

In the last blog in this series, we looked at how knowledge graphs bolster enterprise search capabilities. In this blog, the fourth in a ten-part series on graph technology use cases, we explore how anti-money laundering efforts are aided by graph databases that are able to recognize complicated data relationships in real time.

Use Case #4: Anti-Money Laundering

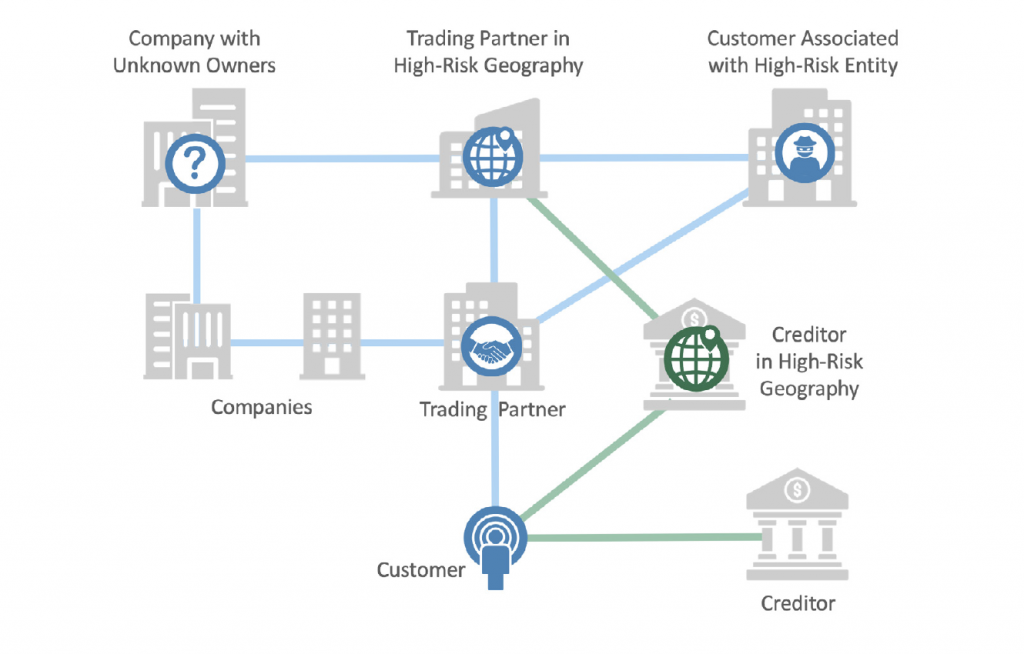

opens in new tabAnti-Money Laundering (AML) schemes today are sophisticated, and often involve indirection to mislead and delude people engaged in dubious activity. Traditional technologies, however, aren’t designed to connect the dots across many intermediate steps.

Inspectors typically spend an exhaustive amount of time poring over reams of data, often taking months doing so, all while the daily transactions pile up.

Why Use Graph Technology for Anti-Money Laundering?

Many traditional technologies aren’t designed to connect the dots, so detecting money-laundering schemes requires a tremendous amount of laborious effort. Teams of inspectors are burdened with manually going through gobs of data.

Then, there’s the sheer variety of money-laundering tactics taking place today:

- Structuring (aka smurfing)

- Bulk cash smuggling

- Cash-intensive businesses

- Trade-based laundering

- Shell companies and trusts

- Round-tripping

- Bank capture

- Casinos and other gambling

- Real estate

- Cash salaries

- Life insurance business

With large and growing volumes of data assets, you need a technology solution that accommodates the size and variety of connections in your dataset.

opens in new tabGraph databases capable of recognizing complex data relationships with real-time query performance are a powerful weapon against the murky world of money laundering and embezzlement.

Example: Money Transfer Service

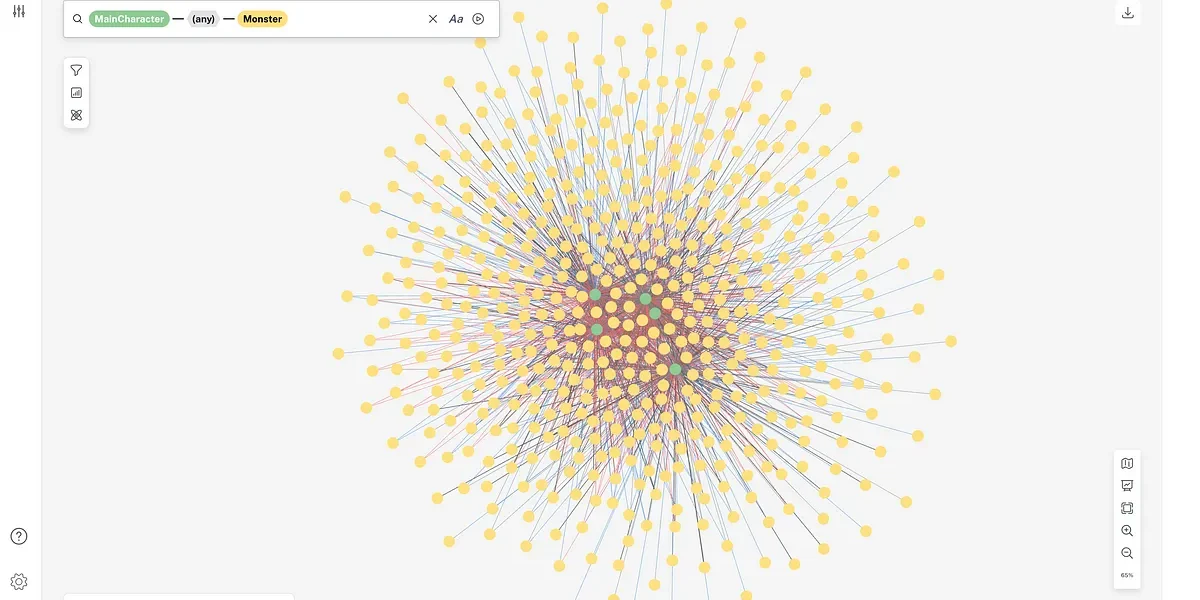

A Compliance Manager at a Money Transfer Service knew they needed a software tool that would allow AML investigators to see patterns of transfers, which reach into the hundreds of thousands of daily transactions.

This Money Transfer Service, who moves nearly $600 billion a year, needed a way to detect “smurfing” activity, which thrives on splitting large sums of illicit funds into a hidden network of beneficiaries.

Rightfully so, the international money transfer industry is highly regulated, and the company complies with anti-money laundering (AML) requirements in every country where it operates (150 worldwide).

“We are continuously looking to improve our systems and processes,” the Compliance Manager said, “and we reviewed mapping technology with the FIU (European Financial Intelligence Unit) and immediately saw the potential this type of tool could have for our business.”

“When we saw Neo4j, we understood that it was opens in new tabthe best tool because it offered a dynamic way of looking into the data,” they said. “Our [traditional] tools were all based on SQL technology, and it’s impossible to have the dynamic approach Neo4j can give us in this investigation process.”

In just a few clicks, Neo4j processes this company’s immense amount of data dynamically and in real time, allowing the money transfer company greater efficiency in both compliance and investigatory process.

In terms of one big case spanning several countries and at least two continents, the Compliance Manager said, “Neo4j allowed us to see the whole picture … The critical element of the suspicion was the journey – and it was obvious when you looked at it with Neo4j.”

Since fully deploying Neo4j, the company is able to pursue criminal cases 20 times faster than with traditional tools, and they have “defined the benchmark” for investigatory compliance in their industry.

Conclusion

With a graph database, you continually improve the detection of money laundering by accommodating new data sources and types – without a rewrite of your opens in new tabdata model. Built-in high availability features ensure user data is always accessible to your mission-critical AML engine.

Unlike relational databases, a graph stores interconnected data, making it easier to detect fraudulent activity, regardless of the depth or shape of the data.

The next article in this ten-part series, will examine how graph technology helps companies to handle the volume and detailed nature of data necessary for optimal supply chain management.